Talking bank transfer for tax deductions: what is it and how to complete it?

The

wire transfer for tax deductions is a type of bank transfer that must contain some specific information, including the object of the transaction, the amount and the tax code of the beneficiary.

- First, you need to check that your bank offers this service. If not, you can request it or go to a different bank;

- Then you have to fill in the transfer form correctly. It is important to pay particular attention to the "causal" field, where the object of the transaction must be specified in detail and precisely;

- Finally, it is important to keep the receipt to be able to use it as proof in the event of any checks by the Revenue Agency.

In general, the use of the wire transfer is an excellent practice for clearly and transparently demonstrating the costs incurred for

building renovation. Only in this way is it possible to demonstrate to the tax authorities that a certain expense has actually been incurred and that you are entitled to the deduction provided for by law.

Always remember to

fill in the tax deduction transfer form correctly and keep the receipt as proof. Read on to find out in detail: what it is, how to complete it and much more.

What is a wire transfer?

In simple terms, it is a form of payment which provides for the insertion, in the transfer reason field, of detailed information on the reason for the transaction.

The wire transfer represents a means of financial transaction that offers a series of relevant information data, which certify the payment made for specific interventions aimed at energy requalification or restructuring. These interventions, which we explore in depth in the section of the

bonus fixtures blog, are incentivized and deductible according to state provisions. Through the use of this type of bank transfer, the Revenue Agency is able to access the details of the transaction in order to identify and apply tax breaks provided for by current legislation.

Basically, when you make a talking bank transfer

you have to specify the reason why you are sending that money . For example, if you are paying the rent for the apartment, you must write "rent for the month of April 2021", or if you are making a payment for a professional service, you must indicate the name of the professional and the nature of the service.

The use of the wire transfer is mandatory for some types of payments, such as those destined abroad or those exceeding 1,000 euros.

What does transfer for tax deductions mean?

In the bank transfer

, various additional information is included with respect to the standard ones, such as for example the reason for the payment or the tax code of the beneficiary. In this way it is possible to demonstrate to the Revenue Agency that the payment made was intended for a specific expense which gives the right to a tax deduction.

For example, if you make a bank transfer to pay for energy redevelopment interventions in your home, you will be able to obtain the 50% tax deduction provided for by law. But in order for the deduction to be valid, all the necessary information must be indicated in the bank transfer, such as for example the tax code of the company that carried out the work and the reason for "energy redevelopment".

The same goes for other expenses that qualify for tax deductions, such as medical expenses or those related to building renovations. In these cases, it is essential to use a wire transfer in which all the information necessary to demonstrate that the payment made was intended for a specific expense which entitles you to a tax deduction.

What are the advantages of the wire transfer?

First of all, this tool allows you to

avoid possible misunderstandings between the sender and the recipient of the transaction. Thanks to the message associated with the bank transfer, in fact, it will be possible to immediately understand the reason for the transaction and therefore avoid any misunderstandings.

Furthermore, the wire transfer represents a valid aid for those who make

recurring payments . For example, if you have to pay a bill every month, you can insert a message in the bank transfer indicating the reason for the payment. In this way, you will avoid having to remember the reason for the payment every time and you will be able to proceed with the transaction faster and more efficiently.

Another advantage of the wire transfer concerns the

traceability of the transactions. Thanks to the message associated with the transfer, it will be possible to know exactly what the money sent was intended for. This aspect is particularly important for commercial activities that need to keep all money in and out of money under control.

Finally, the wire transfer represents a useful solution also for those who have to

send money abroad . Thanks to the message associated with the transfer, it will be possible to specify the reason for the payment and thus avoid any problems with the tax authorities.

Who can do the talking transfer?

The answer is simple:

everyone. There are no limitations or restrictions on the type of customer who can make a wire transfer.

However, there are some precautions to follow to avoid any problems. First of all, it is important that the motivation entered in the "causal" field is truthful and correct. It is not possible to use this field for purposes other than those related to the transaction in question.

Also, you have to pay attention to the words you use. Certain expressions could in fact be considered suspicious by the competent authorities and trigger more in-depth checks.

Who is the beneficiary of the wire transfer?

Also in this case the answer is easy to give:

anyone with a bank or post office account . There are no particular restrictions on the type of account or the bank used, so both individuals and companies can receive wire transfers.

The choice of the beneficiary obviously depends on the type of operation to be carried out. For example, if you have to pay an invoice, the recipient will be the company or professional to whom you have to pay the debt. If, on the other hand, you want to make a gift or send money to a friend or relative, then the beneficiary will be the person himself.

In both cases, it is important to carefully check the recipient's data before making the transfer. In particular, it is necessary to check that the IBAN is correct and that it actually corresponds to the person or company to which you want to send the money. This verification is essential to avoid errors or scams.

Where is the wire transfer made for building interventions?

In general, this type of transfer can be made

to any bank or financial institution . However, it is important to check the methods and any fees applied in advance.

Alternatively,

you can use online services made available by banks. In fact, most financial institutions offer the possibility of making talking transfers via internet banking or a mobile app. Even in this case, however, it is advisable to read the conditions of use carefully and check for any additional costs.

What is the difference between a wire transfer and a regular wire transfer?

The speaking bank transfer

requires the insertion of an explanatory reason , or a detailed description of the reason why the transaction is being carried out. This causal is then recorded in the beneficiary's accounts and can be used as proof in the event of disputes or disputes. The normal transfer, on the other hand, simply involves entering the necessary information (amount, IBAN of the recipient, etc.) without any specific description of the reason for the transaction.

The talking bank transfer allows you to provide more details on the transaction and therefore is more useful in case of any problems or doubts about the nature of the same. Furthermore, the fact that the reason for payment is recorded in the beneficiary's accounts makes it easier for both parties involved to manage payments.

Another difference concerns the costs: generally speaking bank transfers have a slightly higher cost than normal transfers. However, this higher cost can be amply justified by the greater security and transparency offered by the wire transfer.

What type of transfer to make for a 50 deduction?

What are the bank transfers that entitle you to the 50% tax deduction? First of all, it should be noted that this concession is valid only for building renovation and energy redevelopment works.

As far as

home renovations are concerned, the deduction is due for interventions on common parts of condominium buildings, such as for example the

extraordinary maintenance of the lift or external doors and windows. Even interventions on private properties, such as the renovation of the bathroom or kitchen, can be the subject of the tax deduction.

As far as energy requalification works are concerned, the deduction is due for interventions aimed at saving energy such as the installation of solar panels or photovoltaic systems. Also included are the thermal insulation of buildings and the replacement of heating systems with heat pump or condensing systems.

In both cases it is important to pay attention to the documentation necessary to take advantage of the tax deduction. In addition to the wire transfer, in fact, it is necessary to keep all the documents relating to the work carried out, such as invoices or procurement contracts.

What transfer to make for the transfer of credit?

We now come to our focus topic:

which bank transfer to make for the transfer of credit ? In this case, we speak of a transfer with a specific reason. The causal must in fact clearly indicate that it is an assignment of credit and the name of the assigned creditor.

To give a practical example, suppose I have a claim on firm XYZ and decide to sell it to firm ABC. When I make the bank transfer for the credit assignment, I will have to insert "

XYZ credit assignment in favor of ABC " as reason.

It is essential to enter a specific reason because in this way possible future problems will be avoided. For example, if Company ABC fails to pay its debt to Company XYZ, Company XYZ could dispute the payment received from the underwriter of the transfer (ie me) claiming that it was in fact a payment unrelated to the debt in question.

Facsimile speaking bank transfer

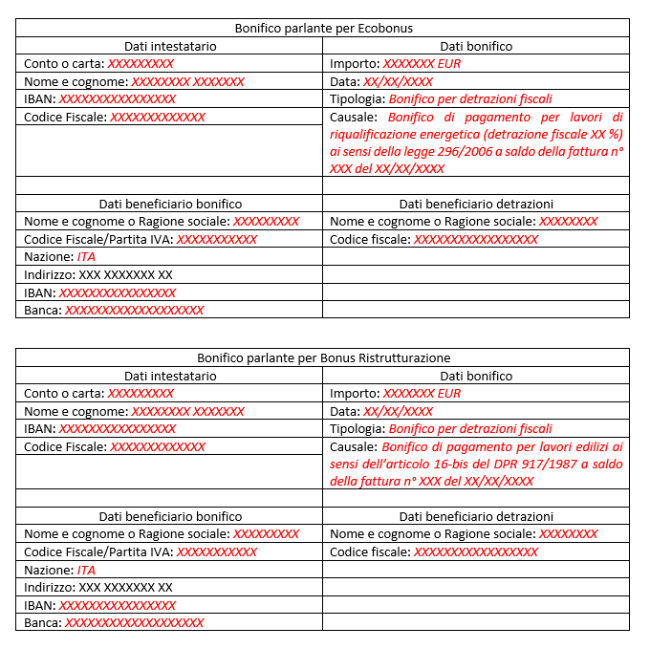

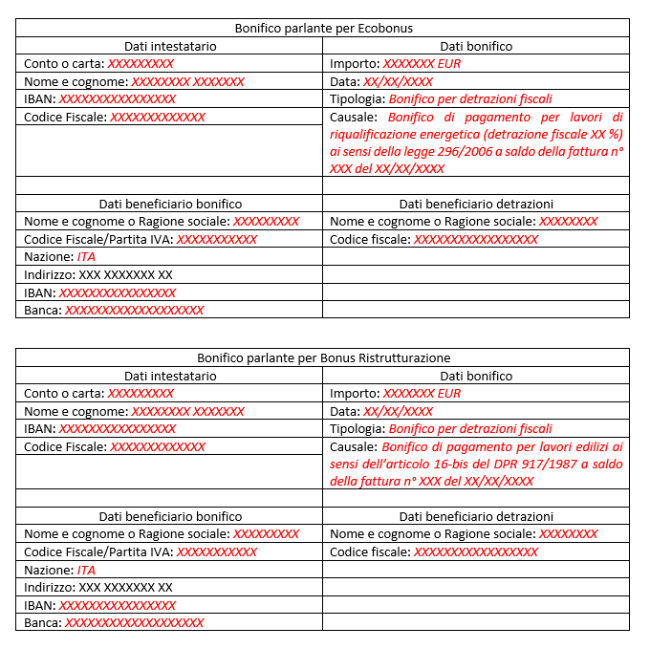

At this point we provide a

facsimile of a talking bank transfer , in order to make it clearer how to fill in this document.

The speaking transfer is a type of bank transfer that requires the insertion of some additional information compared to that necessary for a traditional transfer. In particular, the following data are required:

- Name and surname of the beneficiary;

- IBAN code of the beneficiary;

- Reason for payment.

This information must be entered in the section dedicated to bank transfer notes. The presence of the wire transfer is mandatory for transactions exceeding 1,000 euros.

We now come to the talking bank transfer facsimile. Below is an example of how this document could be compiled:

Given that each institution has its own format, here are two examples of wire transfers containing the data in relation to the two bonuses:

As you can see, the talking bank transfer facsimile involves entering the data required for the talking bank transfer, i.e. the name of the bank, the IBAN of the beneficiary and the reason for the payment. In this way, it will be possible to carry out a secure and traceable transaction.

How to correctly fill in a wire transfer in order to take advantage of the tax deduction?

But how do you fill in the wire transfer correctly? Here are some useful tips:

- Insert the full name of the beneficiary : it is important to indicate the full name of the person to whom the payment is being made, without abbreviations or acronyms;

- Specify the reason for the payment : it is necessary to clearly and precisely indicate the reason for making the transfer. For example, if it is a medical expense, you can write "Health services" or "Purchase of medicines";

- Enter the recipient's tax code or VAT number : it is important to correctly indicate the tax details of the subject to whom the payment is being made, in order to allow the Revenue Agency to easily identify the operation;

- Indicate the number of the invoice or expense document : if you have an expense document, such as an invoice or a receipt, it is advisable to indicate its number in the wire transfer;

- Verify the data entered : before making the payment, it is important to carefully check all the data entered in the wire transfer to avoid errors or omissions.

By filling in the wire transfer correctly, it will be possible to take advantage of the tax deduction for the expenses incurred and to guarantee maximum transparency of the operation.

How to correct an incorrect wire transfer?

The wire transfer is a form of bank transfer that allows you to specify the reason for the payment, in order to make it easier to identify the recipient and justify the expense. However,

it can happen that you make mistakes when entering data . In this case, it is important to act promptly to avoid problems and payment delays.

Here are some tips on how to proceed:

- Verify the error : the first step is to carefully check the data entered and identify any error. It could be a wrong number or a missing letter.

- Contact your bank : Once you have identified the error, you should contact your bank immediately to request correction of the transfer. The bank will check the request and make any changes.

- Rush payment : if it is an urgent payment, you can ask your bank to expedite the correction procedure to avoid payment delays.

- Cancellation : if the wrong bank transfer has already been sent and it is not possible to correct it in time, you can request the cancellation of the payment. However, this involves additional costs and may not be possible in all cases.

- Verification of costs : finally, it is important to check whether the correction of the transfer involves additional costs and what are the possible cancellation costs. This way you will avoid unpleasant surprises.

Talking transfer to the post office: is it possible?

Postal transfer: is it possible? The answer is yes, absolutely.

But how does the talking transfer work at the post office? First of all, you need to have a postal current account and access the home banking service. If you haven't already done so, you can request it directly in the mail. Once logged into your online account, select the item "transfers" and then "national transfers". At this point, choose the amount to transfer and enter the beneficiary's information (name, surname and IBAN).

The most important part comes now:

in the "causal" section, you can write whatever you want (obviously respecting the rules of common sense). You can use this section to specify the reason for the payment (for example "July 2021 rent"), or to add useful information to the recipient (for example "birthday gift").

Once the reason has been entered, check all the data carefully and confirm the transfer. After a few minutes you will receive a notification confirming the successful transaction.

Expenses made without direct transfer

The wire transfer is mandatory for some types of transactions, for example those relating to the payment of taxes or social security contributions. But also for other electronic expenses, it is highly recommended to use this feature.

In fact, making an expense without a talking bank transfer can lead to various complications. First, the recipient may not be able to identify the nature of the transaction and may ask the sender for clarification. Also, if it's a recurring payment (such as a subscription), it might be difficult to keep track of the various due dates without a detailed description.

But there are other reasons to use wire transfer as well. For example, in the event of a dispute with the transaction (for example due to an unauthorized debit), the detailed description in the transfer can be useful as proof of the nature of the transaction. Also, if you make a lot of transactions, a wire transfer can help you better track your spending.

In conclusion,

using the wire transfer is always a good idea . I hope I have convinced you of the importance of the talking bank transfer. Remember: entering a detailed description of the transaction is always useful, both for you and for the beneficiary of the transfer.